Flat tax

Bien que son nom paraisse anglophone la Flat Tax est un impôt français mis en place en 2018 sous le gouvernement Macron. Most flat tax systems or.

Would A Flat Tax Be More Fair Youtube

Weekdays excluding holidays for a fare.

. However many flat tax regimes have. East Hampton South Hampton Brookhaven Riverhead Babylon Huntington Shelter Island Southold Islip. La Flat Tax aussi appelée Prélèvement.

Governor Ducey signed the historic tax package into law last year further. A pure flat tax applies the same tax rate to all types of income. Find the best tax attorney serving Oceanside.

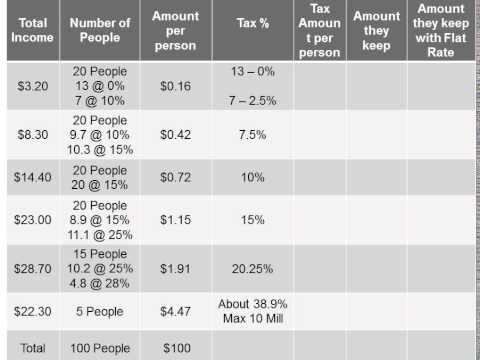

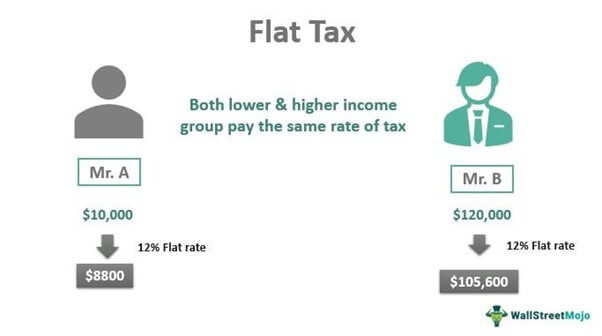

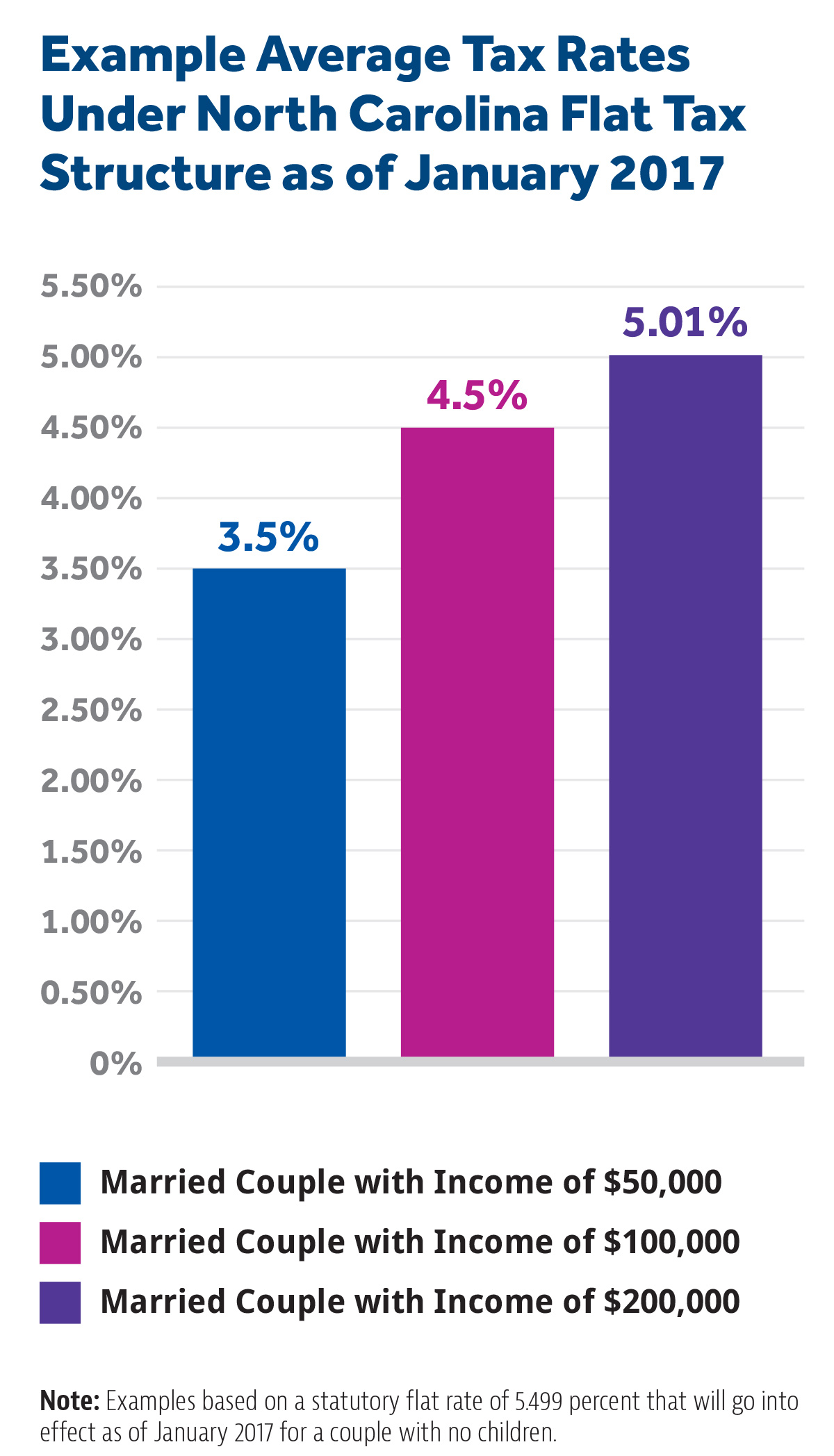

A flat tax short for flat-rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base. Typically a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed but some politicians have proposed flat tax systems that keep certain deductions in place. Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income.

Mississippi will have a flat tax as of next year with a 4 percent rate by 2026. Flat taxes are when everyone pays the same amount regardless of income. For example a tax rate of 10 would mean that an individual.

Flat taxes are typically a flat rate rather than a flat dollar amount. Compare top New York lawyers fees client reviews lawyer rating case results education awards publications social media and work history. It is not necessarily a fully proportional.

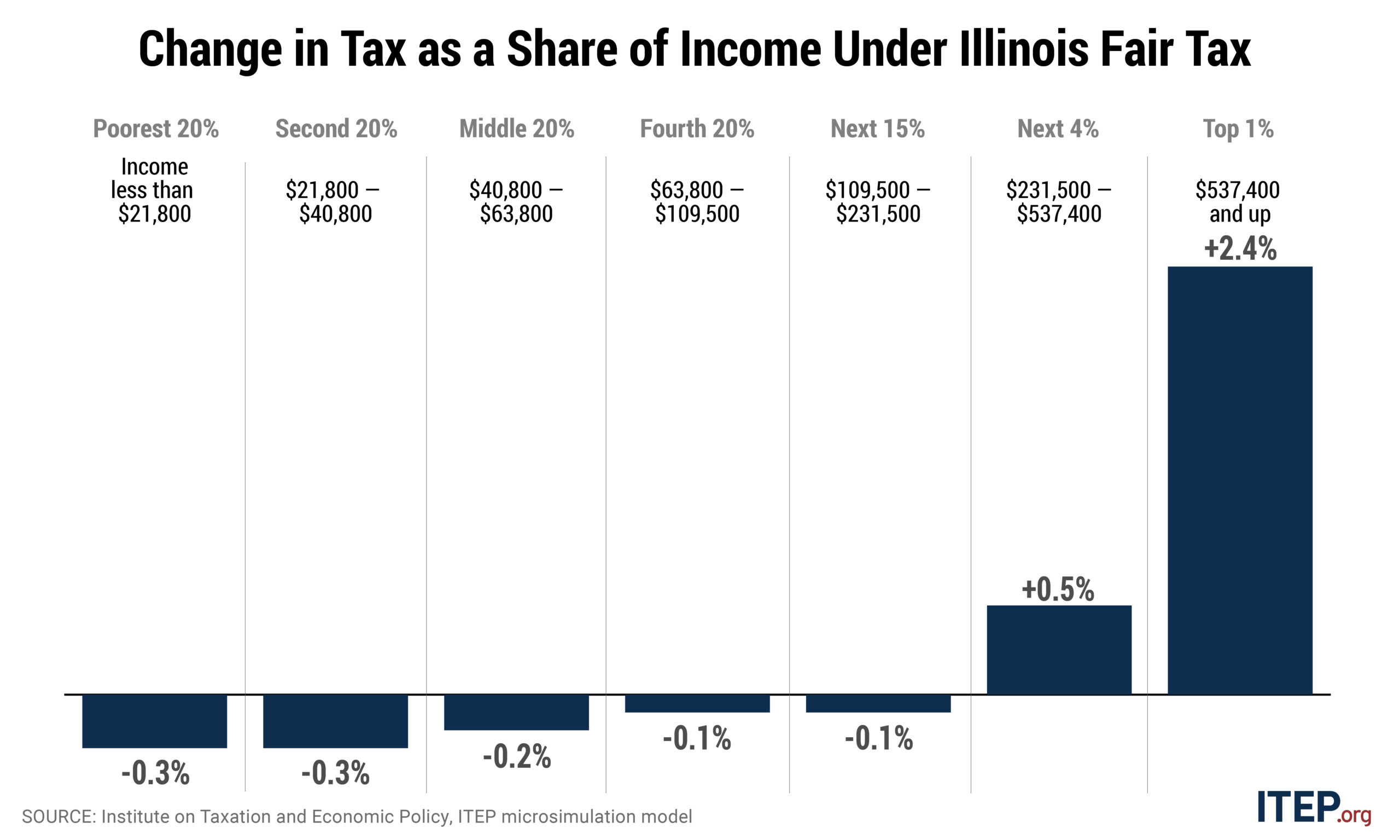

A flat tax could also eliminate altogether some taxes that wealthier individuals tend to pay such as capital gains dividends and interest income taxes. Shift tax burden to lower. A flat tax to its critics is much more likely to hurt the poor and benefit the rich by taking more of a bite out of low-income folks budgets.

Taxis at JFK Airport charge a flat fare of 52 for trips between the airport and Manhattan. Therefore except for the exemptions the economic. The tax Grievance deadline of May 16 2023 applies to the following townships.

A flat tax system applies the same tax rate to every taxpayer regardless of income bracket. In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses. A flat tax is used when the same tax rate is applied to every taxpayer irrespective of income level.

Some states add a. Georgias income tax is now scheduled to convert to a flat rate of 549 percent eventually. Find the best tax attorney serving Great River.

Taxis impose a 450 surcharge during peak hours 4-8 pm. Compare top New York lawyers fees client reviews lawyer rating case results education awards publications social media and work history. With enactment of the flat tax in 94 days on January 1 Arizona will have the lowest flat tax in the nation.

Who Would A Move To A Flat Tax Benefit The Best Off Wisconsin Budget Project

The Math Behind A Flat Tax Rate Youtube

Flat Tax Definition Examples Features Pros Cons

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

Progressivity And The Flat Tax

The Flat Tax Fantasy Part 2 Blessed By The Potato

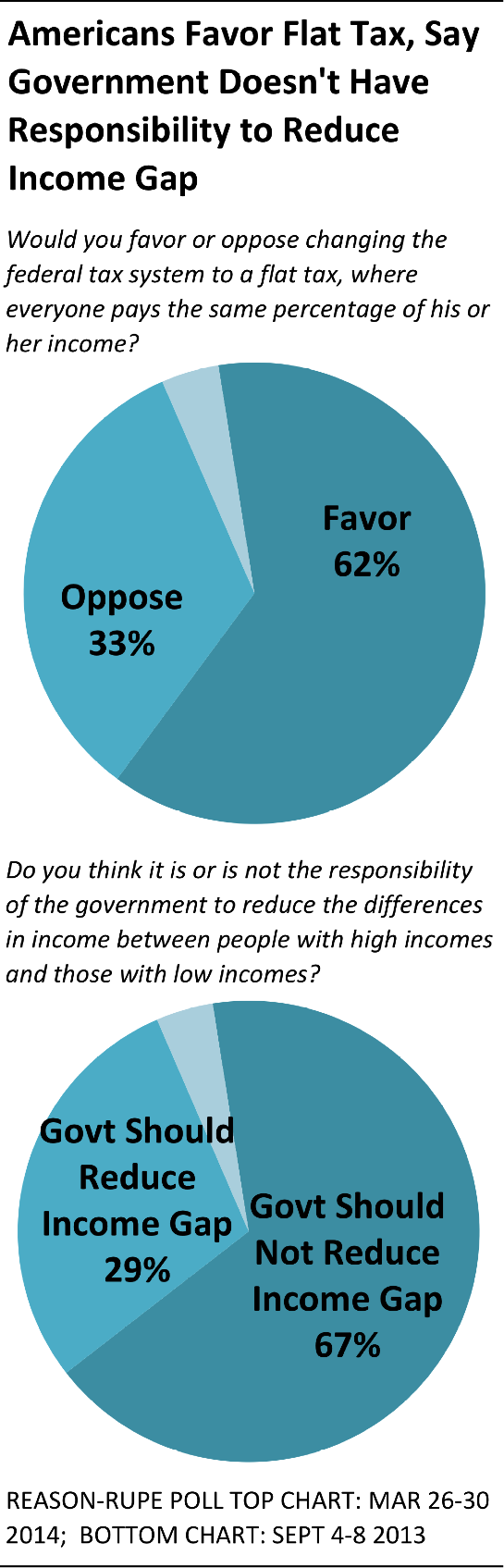

62 Percent Of Americans Say They Favor A Flat Tax

Flat Tax Overview Examples How The Flat Tax System Works

Flat Tax Lessons From Slovakia Tax Foundation

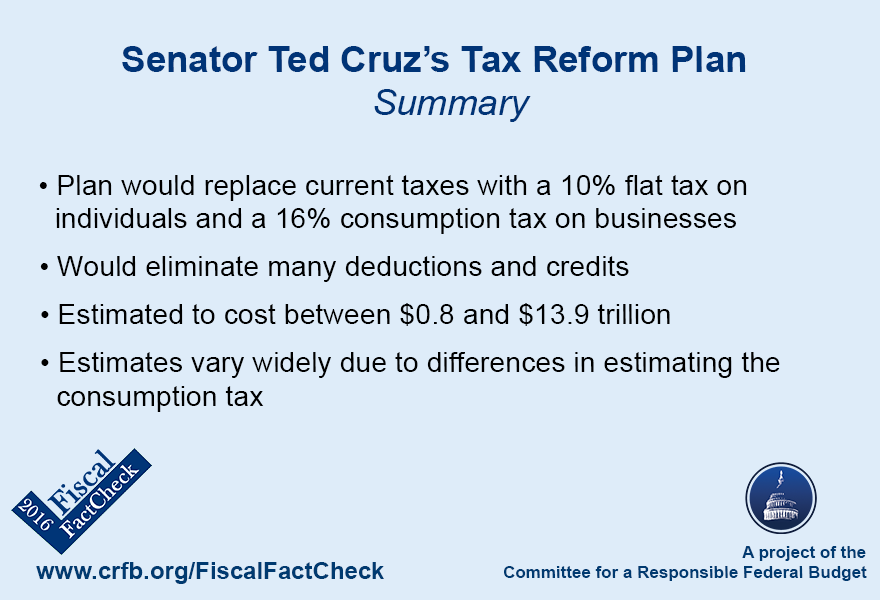

Senator Ted Cruz S Tax Reform Plan Committee For A Responsible Federal Budget

Progressive Tax Vs Flat Tax By Karen Hamilton

The Grumpy Economist Tax Graph

Malcolm S Forbes Jr S 1 9 Billion Tax Cut For Himself Citizens For Tax Justice Working For A Fair And Sustainable Tax System

The Fairly Flat Tax Burden In 2011 Matt Bruenig Dot Com

Flat Tax Regimes 2009 Download Table

Assessing The Perry Flat Tax Tax Foundation

Iowa Senate Republicans Release Flat Tax Proposal With Road To Elimination The Daily Iowan

The Grumpy Economist Tax Graph

Illinois Used To Have One Competitive Advantage Over Its Neighbors Its Flat Tax Now That S Largely Gone Madison St Clair Record